st louis county personal property tax lookup

Start Your Homeowner Search Today. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802.

Property Details Search Property Details Search

Louis County Auditor 218-726-2383 Ext2 1.

. The value of your personal property is assessed. Louis County Auditor St. Louis County Assessors website for contact information office hours tax.

What would you like to see. May 15th - 1st Half Real Estate and Personal Property Taxes are dueStLouis County Auditor StLouis County Courthouse 100 N. Search Any Address 2.

St Louis Countys Mounted Patrol. Property Details Search 2022 Payable in 2023 The Property Search Data is updated on a daily basis. Get In-Depth Property Tax Data In Minutes.

41 South Central Clayton MO 63105. You can spot them most often at Queeny Park Lone Elk Park and. Property Tax Look Up.

Real Estate and Property Information Taxes valuation assessment sales info land use Boundary. Louis County Parcel Tax Lookup. Louis County Auditor 100 N.

Louis County Missouri is 2238 per year for a. What is the property tax rate in St Louis County MO. 1200 Market St.

Louis County Parcel Tax Lookup best appsstlouiscountymngov. Assessments are due March 1. To determine how much you owe perform the following two.

Monday - Friday 8AM - 430PM. May 15th - 1st Half Real Estate and Personal Property Taxes are due. Have you met Storm and Bemo of our St.

Ad Find Information On Any Your County Property. Choose a search type. Home Page - St.

How much personal property tax do I owe Missouri. Louis County Parcel Tax Lookup. E-File Your 2022 Personal Property Assessment.

Ad Just Enter your Zip Code for Property Records in your Area. Use your account number and access code located on your assessment form and follow the prompts. Instructions to update your name or mailing address of record for Personal Property vehicle boat etc in the City of St.

November 15th - 2nd Half Agricultural Property Taxes are due. W Room 214 Duluth MN. Home Page - St.

Tax Lookup - St. Enter in the Parcel ID to search for. 800 am - 500 pm.

Expert Results for Free. Mail payment and Property Tax Statement coupon to. Important Numbers Individual Personal Property - 314 622.

Find Property Tax Records Get Accurate Home Values Online. Find Your County Online Property Taxes Info From 2021. County-wide reassessments take place every two years in odd numbered years.

Parcel ID Address Plat Sales Search. See Property Records Tax Titles Owner Info More. Monday - Friday 8 AM - 500 PM NW Crossings South County.

Just Enter Your Zip to Start. Louis County Parks Mounted Patrol. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property.

The current statewide assessment rate for personal property is 33 13. While property values listed on the assessment rolls are used to calculate annual property taxes the Assessor. Home Page - St.

Tax Forfeit Land Sales. Address Parcel ID Lake. Address Property Search.

The median property tax in St. State Muni Services. Other departments may be able to help if you are looking for.

PO Box 66877.

Birth And Death Records St Louis County Website

Revenue St Louis County Website

Collector Of Revenue St Louis County Website

County Assessor St Louis County Website

Collector Of Revenue Faqs St Louis County Website

County Assessor St Louis County Website

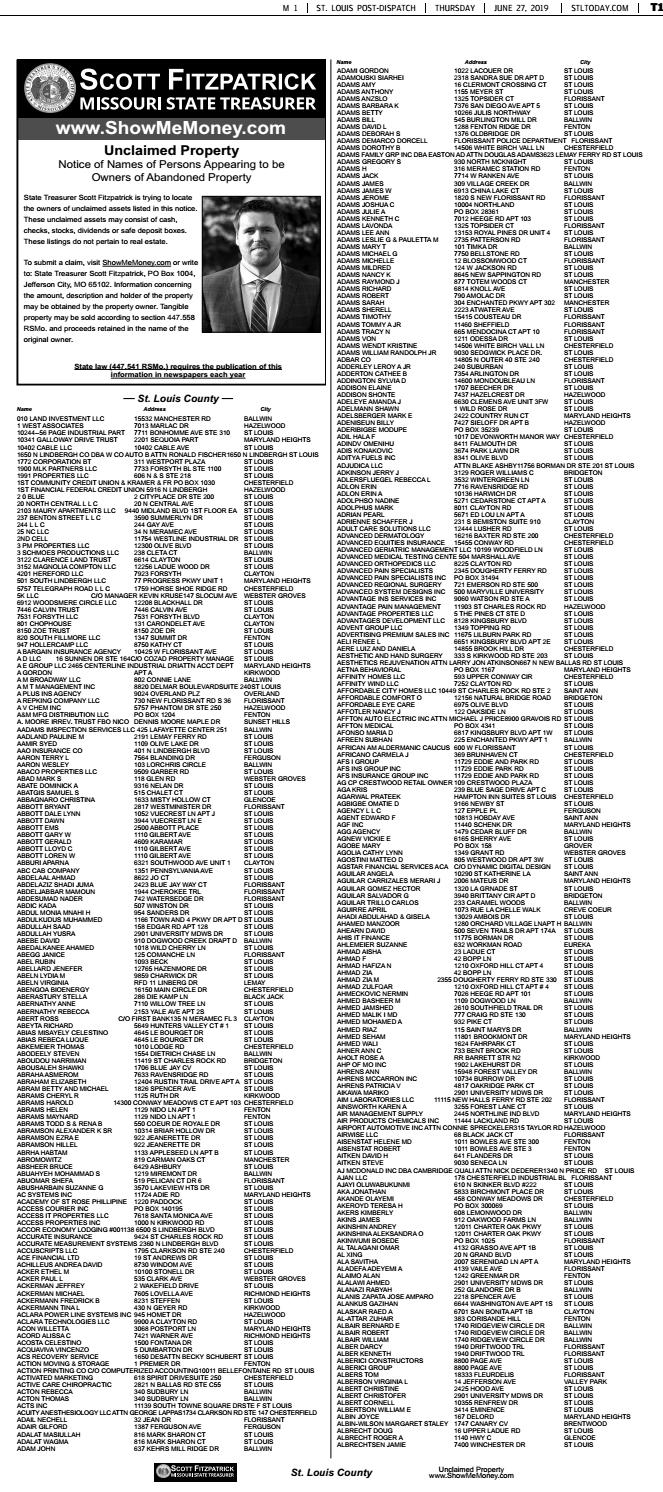

St Louis County 2019 By Stltoday Com Issuu

2014 St Louis County Unclaimed Property By Stltoday Com Issuu

Print Tax Receipts St Louis County Website

Revenue St Louis County Website

County Assessor St Louis County Website

Print Tax Receipts St Louis County Website

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue St Louis County Website